EFTPOS and Autobank

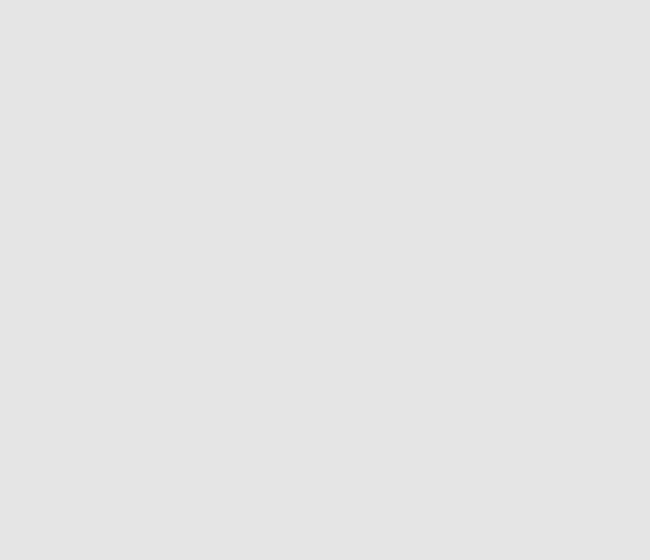

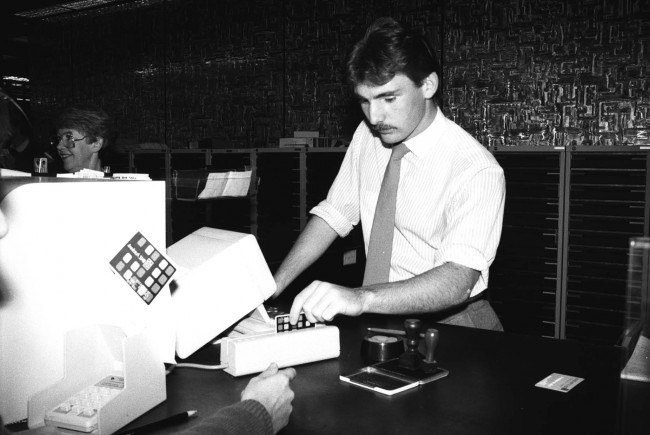

1984 saw BNZ and ANZ join up to launch Autobank ‘self-service banking every day and night’. Customers were issued with Autobank cards which could be used in the Automatic Teller Machine (ATM) network. The Autobank service extended banking hours to 16 hours a day, seven days a week. Customers could make deposits and withdrawals, obtain a balance figure, and transfer funds from one account to another.

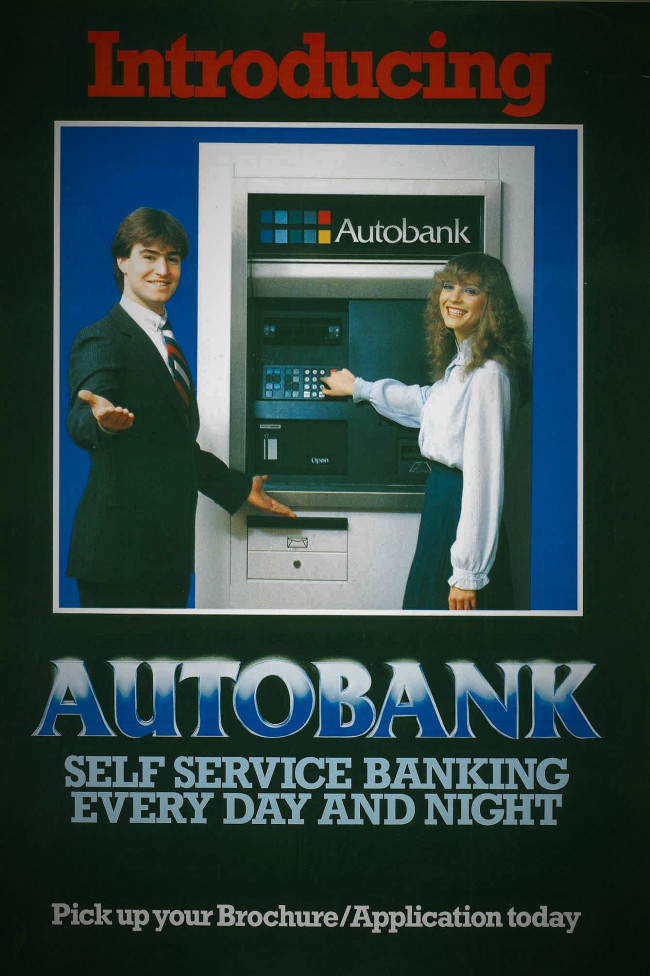

In 1985 Electronic Funds Transfer at Point of Sale or EFT-POS was first introduced in New Zealand through a pilot scheme with petrol stations. EFT-POS could be used with the existing Autobank cards. New Zealand banks were well ahead of the USA and Great Britain in this area due mostly to the national banking system Databank which was used as the platform for the developing electronic banking functions.

EFTPOS was faster and safer than paying by cash or cheque. The funds would be automatically debited from the customers’ account to the suppliers account. There was an initial limit of $200 per day covering both ATM and EFTPOS transactions.

In 1986 BNZ replaced the Autobank card with BNZ Autocard.

The EFTPOS-BNZ story has not all been plain sailing. In 1988 BNZ pulled out of EFTPOS. The reason appears to be financial with transaction charges for the bank for using EFTPOS being around $5.00 per transaction.

BNZ re-joined EFTPOS in 1991 when charges were reduced to 50c per transaction.

Autobank Poster - 1984

BNZ EFTPOS poster - 1985

BNZ teller using Autobank - c1985