1840s

•

1840

Treaty of Waitangi signed

1840s

•

1845 to 1866

The New Zealand Wars / Ngā pakanga o Aotearoa

1850s

•

1858

Te Wherowhero becomes first Maori King

1850s

•

1859

Darwin publishes 'Origin of the Species'

1860s

•

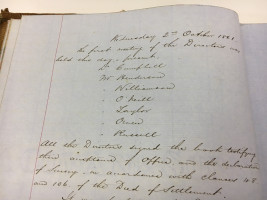

1861

Founding of the Bank of New Zealand

Read more...

Read more...

On 11 June 1861 The Southern Cross newspaper reported that a meeting had been held on the previous day to discuss the establishment of a bank.

1860s

•

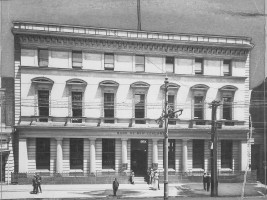

1861

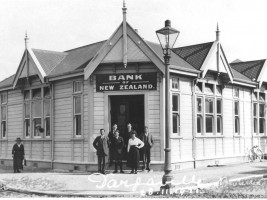

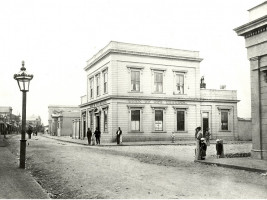

Auckland: The bank's first office

Read more...

Read more...

BNZs first office opened on Queen Street, Auckland.

1860s

•

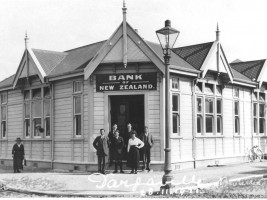

1861

New Plymouth, the King family and the Stone Cottage

Read more...

Read more...

New Plymouth Branch Opened on the 18 November 1861, this was the second branch of the bank to open after Auckland.

1860s

•

1861

Otago gold rush begins

1860s

•

1861

New Zealand's first telegraph line - Christchurch to Lyttelton

1860s

•

1861 to 1868

Alexander Kennedy appointed first General Manager of Bank of New Zealand

1860s

•

1860s

•

1860s

•

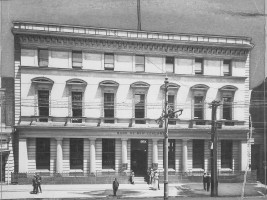

1862 to 1992

London: Keep calm and carry on

Read more...

Read more...

BNZ's London office opened on the 1st of October 1862.

1860s

•

1862

Nelson

Read more...

Read more...

The fourth branch to be opened by the bank, Nelson opened for business on 13th January 1862 in small, rented premises in Hardy Street.

1860s

•

1862

First gold shipment from Dunedin to London

1860s

•

1862

Bank of New Zealand acquires the account of the central Government from the Union Bank

1860s

•

1860s

•

1868

Coromandel gold rush begins

1860s

•

1868 to 1888

David Limond Murdoch appointed Chief Executive upon the retirement of Alexander Kennedy. He receives the title of General Manager in 1877.

1860s

•

1869

The University of Otago was founded, this was New Zealand's first University.

1870s

•

1872

Telegraph communication links established between Auckland, Wellington and the Southern Provinces

1870s

•

1872

Bank of New Zealand branch opened in Melbourne, Australia

1870s

•

1876

Telephone invented

1870s

•

1876

Bank of New Zealand branch opened in Levuka, Fiji absorbing Fiji Banking and Commercial Trading Company Ltd.

1870s

•

1877

Primary education system established in New Zealand

1870s

•

1879 to 1896

The Long Depression

1880s

•

1882

First shipment of frozen meat leaves for England

1880s

•

1886

Eruption of Mount Tarawera

1880s

•

1886

Oil discovered in Taranaki

1880s

•

1887

Reefton becomes first New Zealand town to have electricity

1880s

•

1888

Katherine Mansfield born

1880s

•

1888 to 1889

John Murray appointed General Manager, 5th June 1888

1880s

•

1889 to 1890

George Edmeades Tolhurst appointed General Manager, 14th June 1889

1890s

•

1890

Bank of New Zealand head office moves to London to 'broaden the management expertise and improve confidence'

1890s

•

1890

John Marten Butt appointed Acting General Manager

1890s

•

1890 to 1894

William Turton Holmes appointed General Manager, 25th December 1890

1890s

•

1893

Women get the vote in New Zealand - a world first

1890s

•

1894

The New Zealand Government became a majority owner of the Bank of New Zealand after it nearly collapsed due to the Long Depression

1890s

•

1894 to 1895

C G Andrews appointed Acting General Manager

1890s

•

1895

The Colonial Bank of New Zealand

Read more...

Read more...

In 1895 the BNZ purchased The Colonial Bank of New Zealand, 21 years after it had first opened for business on High Street, Dunedin.

1890s

•

1895 to 1897

Henry Mackenzie appointed General Manager, 25th November 1895

1890s

•

1897 to 1899

Charles George Tegetmeier appointed General Manager, 30th April 1897

1900s

•

1900 to 1903

James Embling appointed General Manager, 1st January 1900

1900s

•

1901

Queen Victoria dies

1900s

•

1903 to 1906

Alexander Macintosh appointed General Manager, 22nd June 1903

1900s

•

1904

The New Zealand Government becomes a shareholder in Bank of New Zealand

1900s

•

1906 to 1907

Alexander Michie appointed General Manager, 15 January 1906

1900s

•

1907

New Zealand becomes a self-governing dominion

1900s

•

1907 to 1920

William Callendar appointed General Manager, 1st April 1907

1910s

•

1914 to 1918

Keeping the doors open

Read more...

Read more...

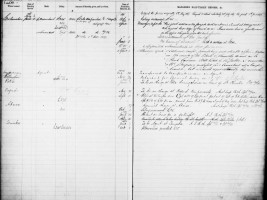

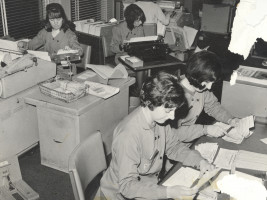

During WW1, 560 BNZ Bank Officers enlisted in the Expeditionary Forces.

1910s

•

1915

Gallipoli Campaign

1910s

•

1918

Influenza pandemic: the Juniors are in charge

Read more...

Read more...

As World War 1 ended and the soldiers returned home to New Zealand, they unwittingly brought back an influenza that ravaged the country.

1910s

•

1918

Armistice signed in Europe

1920s

•

1920 to 1933

Sir Henry Buckleton appointed General Manager, 1st February 1920

1920s

•

1923

War Memorial Plaques

Read more...

Read more...

BNZ dedicates plaques to staff killed in WWI and later in WWII.

1920s

•

1926

In it for the long term

Read more...

Read more...

Long term lending was first established to support 'pastoralists and agriculturalists' as a result of the Bank of New Zealand Act 1926.

1920s

•

1927

Television invented

1920s

•

1928 to 1935

The worst years of The Great Depression

1920s

•

1929

Murchison earthquake, 1929

Read more...

Read more...

The Murchison earthquake damaged much of the upper South Island, sadly killing 17 people.

1930s

•

1930s

•

1931

First Bank motor vehicle purchased

1930s

•

1934

The Reserve Bank of New Zealand is established and we stop issuing our own bank notes

1930s

•

1934 to 1939

Frank William Dawson appointed General Manager, 1st January 1934

1930s

•

1936

Where there's a will: The W. H Hargreaves trust

Read more...

Read more...

Upon his death, funds from the estate of retired staff member W. H. Hargreaves were bequeathed to financially assist BNZ widows.

1930s

•

1939 to 1945

New Zealand takes part in World War II

1930s

•

1939 to 1945

921 Bank of New Zealand Officers join the Forces during WWII. 54 are killed in action

1930s

•

1939 to 1945

Henry Ralph Hervey Chalmers appointed General Manager, 1st May 1939

1940s

•

1941

Pearl Harbour bombed

1940s

•

1943

To meet the needs of American servicemen, the Bank opens New Zealand's first mobile banking office in a caravan

1940s

•

1944

D-Day

1940s

•

1944

Bank of New Zealand opens New Zealand’s first personal loans department to grant loans to private individuals

1940s

•

1945

Finance Minister Walter Nash publicly announces that the Government intends to nationalise Bank of New Zealand, offering £7,933,000 in cash to 8,500 shareholders

1940s

•

1945 to 1950

Paul Lancelot Porter appointed General Manager, 1st December 1945

1940s

•

1946

First electronic computer

1940s

•

1947

New Zealand becomes fully independant from Britain

1950s

•

1950 to 1953

Korean War

1950s

•

1951

The London Cup

Read more...

Read more...

BNZ London staff were gifted trophies which would become the basis of regionally run London Cup competitions.

1950s

•

1951 to 1962

Richard D Moore appointed General Manager, 1st January 1951

1950s

•

1952

King George VI dies, Elizabeth crowned Queen

1950s

•

1953

Edmund Hillary and Tenzing Norgay reach the summit of Everest

1950s

•

1954

Motor bank - Drive In Banking

Read more...

Read more...

BNZ opens the first Motorbank in New Zealand at Vivian Street Branch, Wellington. Allowing customers to conduct their banking from the comfort of their own car at specially designed Teller kiosks.

1950s

•

1954

Coat of Arms granted to Bank of New Zealand

1950s

•

1957

Sputnik launched by Russia

1950s

•

1950s

•

1958

PAYE introduced

1960s

•

1961

Bank of New Zealand celebrates its centenary

1960s

•

1962

First American in space

1960s

•

1962 to 1967

J G Souness appointed General Manager, 1st March 1962

1960s

•

1963

John F. Kennedy assassinated

1960s

•

1964

The start of BNZ Savings

Read more...

Read more...

Following the Private Savings Bank Act 1964, the Bank of New Zealand Savings Bank was established.

1960s

•

1964 to 1965

Vietnamese War

1960s

•

1960s

•

1960s

•

1967

Decimal currency introduced

1960s

•

1967 to 1973

John Frederick Earnshaw appointed General Manager, 1st January 1967

1960s

•

1969

Neil Armstrong walks on the moon

1970s

•

1973 to 1979

Bruce Henderson Smith appointed General Manager, 1st July 1973

1970s

•

1970s

•

1974

Commonwealth Games held in Christchurch

1970s

•

1974

BNZ introduces New Zealand's first bank card product with the Nationwide Card as part of the Nationwide Bank Account. The card was a cheque guarantee card.

1970s

•

1978

Bank of New Zealand introduces VISA as a debit card to current accounts. In 1980 it becomes a credit card

1970s

•

1979

Cellular phones invented

1980s

•

1980 to 1985

William J Shaw appointed General Manager, 1st January 1980

1980s

•

1982

War in the Falkland Islands

1980s

•

1984

Deregulation of the New Zealand financial industry commences

1980s

•

1984

BNZ and ANZ join up to launch Autobank ‘self-service banking every day and night’. Customers were issued with Autobank cards which could be used in the Automatic Teller Machine (ATM) network. Customers could make deposits and withdrawals, obtain a balance figure, and transfer funds from one account to another.

1980s

•

1985

EFTPOS is first introduced to New Zealand through a pilot scheme with petrol stations

1980s

•

1985 to 1989

Robert Baker McCay appointed General Manager, 13st June 1985

1980s

•

1986

Sailing Away

Read more...

Read more...

BNZ announced its sponsorship of the New Zealand challenge for the America's Cup.

1980s

•

1987

Stock market crash devastates NZ economy

1980s

•

1989

Berlin Wall comes down

1980s

•

1989

Deteriorating asset quality and increasing provisions resulted in a loss of $634 million for Bank of New Zealand. This required a Government rescue package via cash issue

1980s

•

1989 to 1992

Lindsay Pyne appointed General Manager, 1st May 1989

1990s

•

1990s

•

1990

Kiri's Homecoming - Dame Kiri Te Kanawa hits a high note with New Zealanders

Read more...

Read more...

As part of the nation’s 150th celebrations in 1990, (150 years since the signing of the Treaty of Waitangi) the BNZ announced that it would be ‘bringing Kiri home’ for a series of free open-air concerts as part of its gift to the nation.

1990s

•

1990

A second rescue package is announced by the newly appointed National Government due to problems with the Australian Loans book. In a complex deal both the Government and Fay, Richwhite & Company provide the $720 million cash for the bailout.

1990s

•

1990

Commonwealth Games held in Auckland

1990s

•

1991

Gulf War

1990s

•

1992

Bank of New Zealand becomes part of the National Australia Group

1990s

•

1992

Bank of New Zealand opens its first call centre

1990s

•

1992 to 1995

R M C Prowse appointed General Manager

1990s

•

1996

Bank of New Zealand enters into a joint partnership to form Loyalty New Zealand and manage the Fly Buys reward programme

1990s

•

1996 to 1998

Gordon J Wheaton appointed CEO, 08 January 1996

1990s

•

1997

Britain turns Hong Kong over to China

1990s

•

1997

Princess Diana dies in Paris car crash

1990s

•

1997

For the first time, Bank of New Zealand achieves more than $1 billion growth in home mortgage lending in one financial year

1990s

•

1997

Bank of New Zealand introduces Direct Banking – a ‘virtual branch’ which customers can access via phone or fax

1990s

•

1997

First female Prime Minister in NZ - Jenny Shipley

1990s

•

1998

Google founded

1990s

•

1998

Bank of New Zealand Private Bank launched

1990s

•

1998 to 2000

Mike Pratt appointed CEO, 5th May 1998

1990s

•

1998

BNZ is the first bank in NZ to offer paid parental leave to eligible employees.

1990s

•

1999

Internet Banking

Read more...

Read more...

Bank of New Zealand launches BNZ Internet Banking, followed by online securities trading and FX dealing.

1990s

•

1999

Helen Clark becomes the first elected female Prime Minister in NZ

2000s

•

2000

New Zealand banks are the first to open for business in the new millenium

2000s

•

2000 to 2007

Peter Thodey appointed CEO, March 2000

2000s

•

2001

September 11 hijacking and the World Trade Centre tragedy

2000s

•

2001

BNZ Finance Limited amalgamates with Bank of New Zealand

2000s

•

2001

First 'Lord of the Rings' movie is released to global acclaim

2000s

•

2003

War in Iraq

2000s

•

2003

Internet banking for business customers is launched

2000s

•

2003

Bank of New Zealand Museum opens

2000s

•

2003

New Zealand population reaches four million

2000s

•

2004

Facebook launched

2000s

•

2005

Civil Unions come into effect in NZ

2000s

•

2006

Online statements, text alerts and extra security feature 'Netguard' for internet banking is introduced

2000s

•

2007

Global economic downturn

2000s

•

2007

In a major building programme BNZ co-designs and tenants three new buildings at Quay Park and 80 Queen Street in Auckland and Harbour Quays in Wellington

2000s

•

2007 to 2008

Cameron Clyne appointed CEO, 20th February 2007

2000s

•

2008

BNZ joins the National Retailers Association

2000s

•

2008

Bank of New Zealand refreshes brand identity and changes name to BNZ

2000s

•

2008

Breaking traditional banking barries, BNZ introduces innovative ways for customer banking and money management. 'Branches' become 'stores' reflecting BNZ's customer-focused approach to retail banking.

2000s

•

2008

Barack Obama is elected President of the United States amid the US economic crisis

2000s

•

2008 to 2014

Andrew Thorburn appointed CEO, 1st October 2008

2000s

•

2009

BNZ becomes carbon neutral

2000s

•

2009

BNZ sponsorship of the Katherine Mansfield Awards celebrates 50 years

2010s

•

2010

Haiti earthquake kills 23,000

2010s

•

2010

7.1 earthquake rocks Canterbury

2010s

•

2011

Christchurch earthquake kills 185

2010s

•

2012

Queen Elizabeth II celebrates her Diamond Jubilee

2010s

•

2013

Same sex marriage legalised in NZ

2010s

•

2014 to 2018

Anthony Healey appointed CEO

2010s

•

2016

United Kingdom votes to leave the EU

2010s

•

2016

7.8 earthquake hits Kaikoura on 14 November

2010s

•

2016

BNZ Centre in Christchurch opened in December

2010s

•

2017

In partnership with PWC the 'John Waller Memorial Scholarship' is established at Canterbury University.

2010s

•

2018

Angela Mentis, the first female managing director and CEO of BNZ appointed January 2018

2010s

•

2019

COVID-19 is first detected in Wuhan, China in December 2019. The virus was declared a pandemic by the WHO on the 11 March 2020.

2010s

•

2019

Scam Savvy week is launched. During August, 3,500 BNZers volunteered to help more than 55,000 New Zealander's feel safer online. Not limited to one week the bank continues to provide resources to help keep New Zealander's safer on line.

2020s

•

2021

BNZ and Southern Pastures sign NZ's first farm sustainability-linked loan. Southern Pastures will receive financial incentives for hitting environmental targets such as improvements in water quality, biodiversity and reductions in carbon.

2020s

•

2021

Dan Huggins appointed CEO, 1st October 2021

BNZ Staff News introduced as a monthly newsletter for bank staff.